Farmer Sentiment Improves Despite Financial Performance Concerns

Corn and soybean prices have fallen since June, yet farmers remain optimistic.

August 20, 2024

by Morgan French, Purdue University

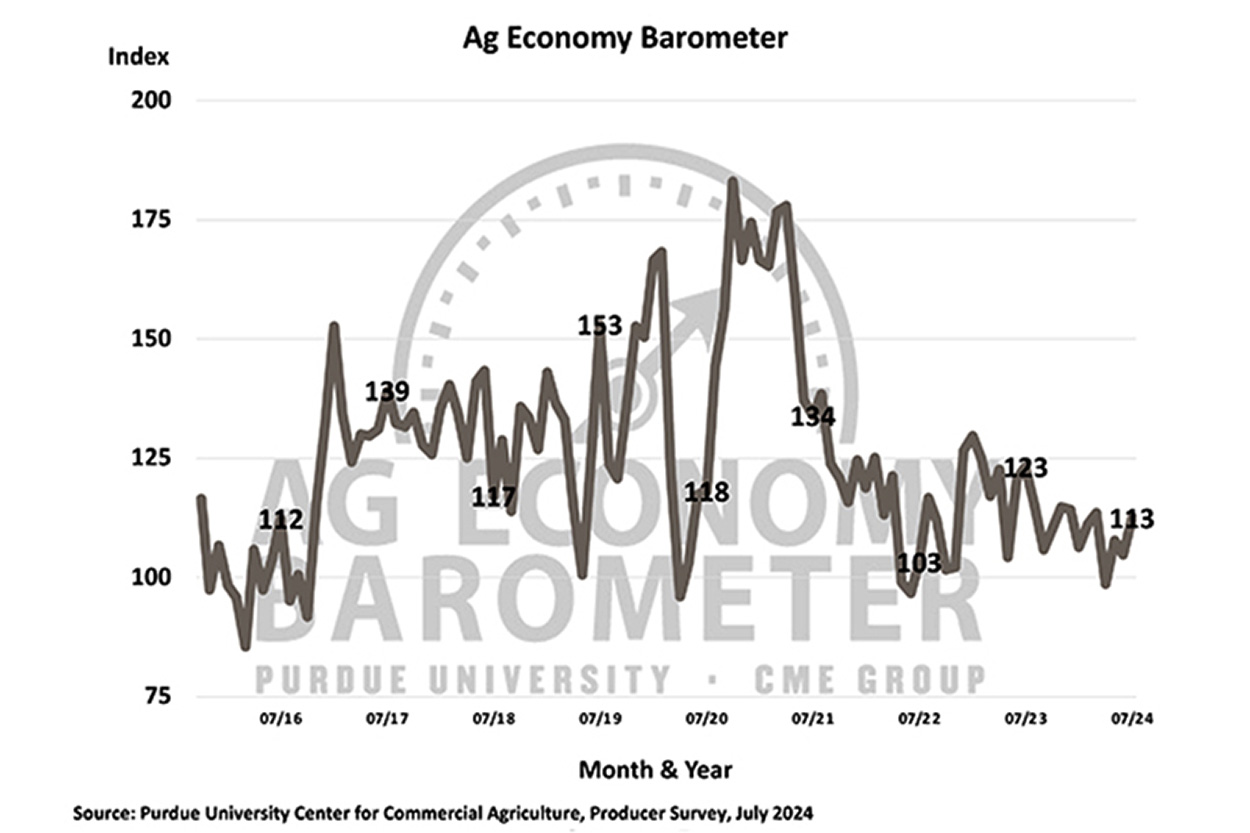

Three broad-based measures of farmer sentiment improved in July as the Purdue University/CME Group Ag Economy Barometer index rose 8 points to 113, the Index of Current Conditions increased by 10 points to 100, and the Index of Future Expectations, at 119, was 7 points higher than a month earlier. Despite declines in corn and soybean prices from mid-June to mid-July (Eastern Corn Belt cash prices fell 11% and 5%, respectively), farmer sentiment improved in July. Responses to the individual questions attribute this positive shift to fewer respondents reporting worsened conditions compared to a year ago and a decrease in those expecting negative future outcomes.

This month’s Ag Economy Barometer survey was conducted July 15-19, 2024.

Farmer sentiment improves despite lower projected crop and livestock prices. [Graphic by Purdue/CME Group Ag Economy Barometer/James Mintert.]

The July survey showed that high input costs remained the biggest concern for 34% of farmers. Additionally, the risk of lower crop and livestock prices continues to worry producers, with 29% citing it as a top concern, up from 25% in June. Reflecting the signals from the Federal Reserve that interest rates have peaked, only 17% of respondents cited rising interest rates as a top concern, down from 23% last month.

The Farm Financial Performance Index dropped 4 points in July to 81 — 6 points lower than in July 2023. The decline in financial performance expectations reflected farmers’ worries about weakening commodity prices and high input costs following improvements in the May and June indices. Although production costs for principal crops, including corn and soybeans, have decreased year over year, output prices have also fallen, raising the possibility of a cost-price squeeze for U.S. crop producers.

“Declines in crop prices point to lower producer incomes this year, so the increase in optimism was somewhat puzzling.” — James Mintert

Despite concerns about farms’ financial performance, the Farm Capital Investment Index rose 6 points in July to 38, though it remains weak, at 7 points lower than in July 2023. This improvement was due to a slight decrease in the number of producers who believe it’s a bad time to make large investments, which dropped from 80% in June to 75% in July.

“Declines in crop prices point to lower producer incomes this year, so the increase in optimism was somewhat puzzling,” says James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture. “Fewer producers citing rising interest rates as a primary concern for the upcoming year corresponds with the modest improvement in their perspectives on capital investments, but respondents continue to express hesitancy to make large investments.”

July saw a small improvement in the Short-term Farmland Value Expectations Index, rising to 118 from 115 in June. This was driven by more respondents expecting stable farmland values during the next year. At the same time, the Long-term Farmland Value Expectations Index dropped 6 points from June to 146, with fewer farmers expecting values to rise during the next five years and more anticipating they will remain unchanged.

As nationwide discussions begin for the 2025 crop year’s farmland leases, the July survey revealed that nearly three-fourths (72%) of crop farmer respondents expect cash rental rates to remain roughly the same as in 2024. Among the remaining respondents, views were nearly evenly divided, with 15% anticipating a rise in rates and 13% expecting a decline.

Editor’s note: Morgan French is a communication and marketing specialist for the College of Agriculture at Purdue University. [Lead photo by Jenna Wagner from Getty Images.]

Angus Beef Bulletin EXTRA, Vol. 16, No. 8-B

Topics: Business , Management , News

Publication: Angus Beef Bulletin