Fewer Cows Going to Market

Cull cow values up 23% for the year, while slaughter is down about 18%.

May 6, 2025

by Steiner Consulting Group

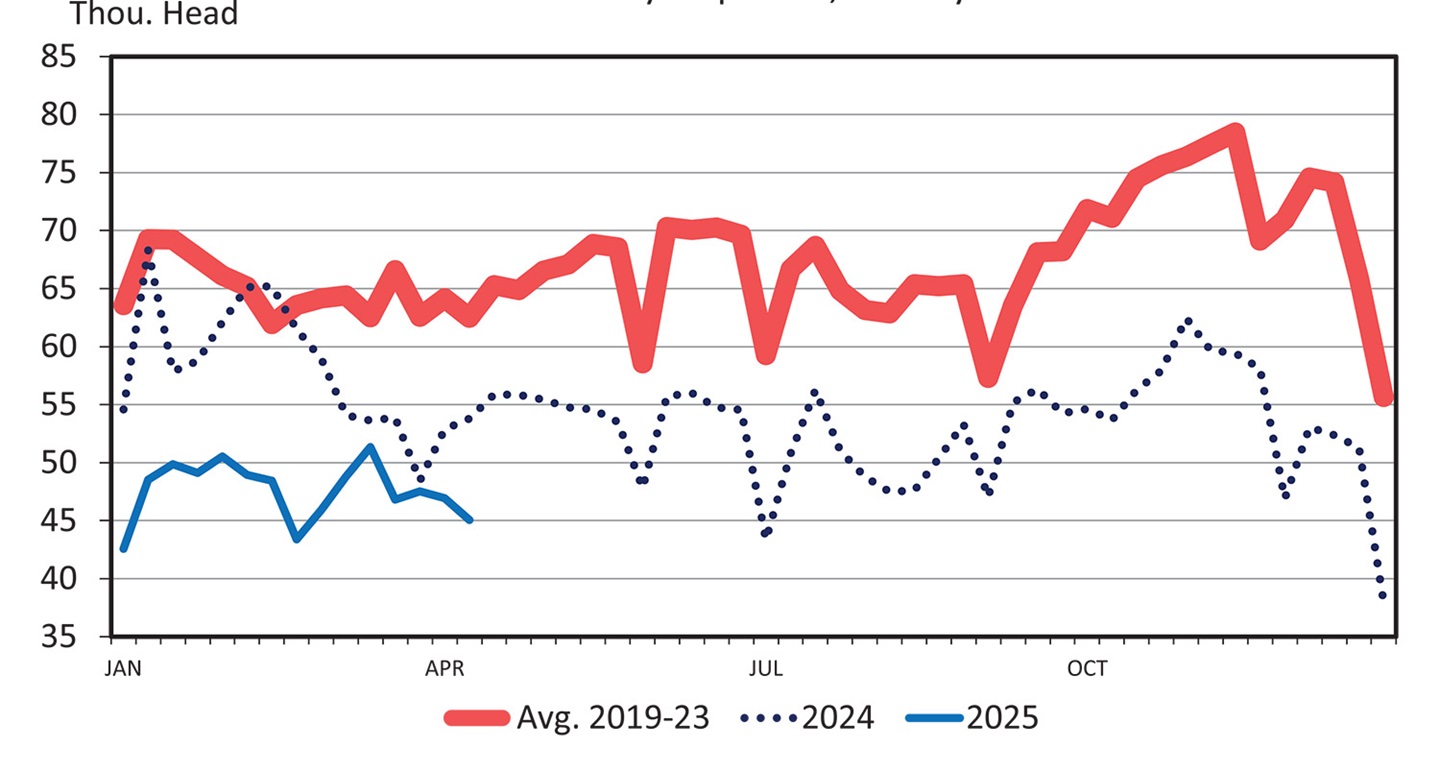

As cull cow prices continue to rise into 2025, the number of cows being slaughtered remains notably lower compared to 2024 and to earlier years. For the week ending April 13, beef cow slaughter totaled 45,100 head, a 16.2% decline from the same week in 2024. Year-to-date declines have been slightly steeper, approaching 18%, with total slaughter at 714,000 head.

In parallel, dairy cow slaughter has also showed year-over-year declines for the same week, falling 14.2% to 47,300 head. However, year-to-date decreases have been less severe, totaling 790,000 head, an 8.1% decline from the same period in 2024.

Fig. 1: Weekly federally inspected beef cow slaughter

Data source: USDA-AMS and USDA-NASS.

Livestock Marketing Information Center • C-S-34 • 04/25/25.

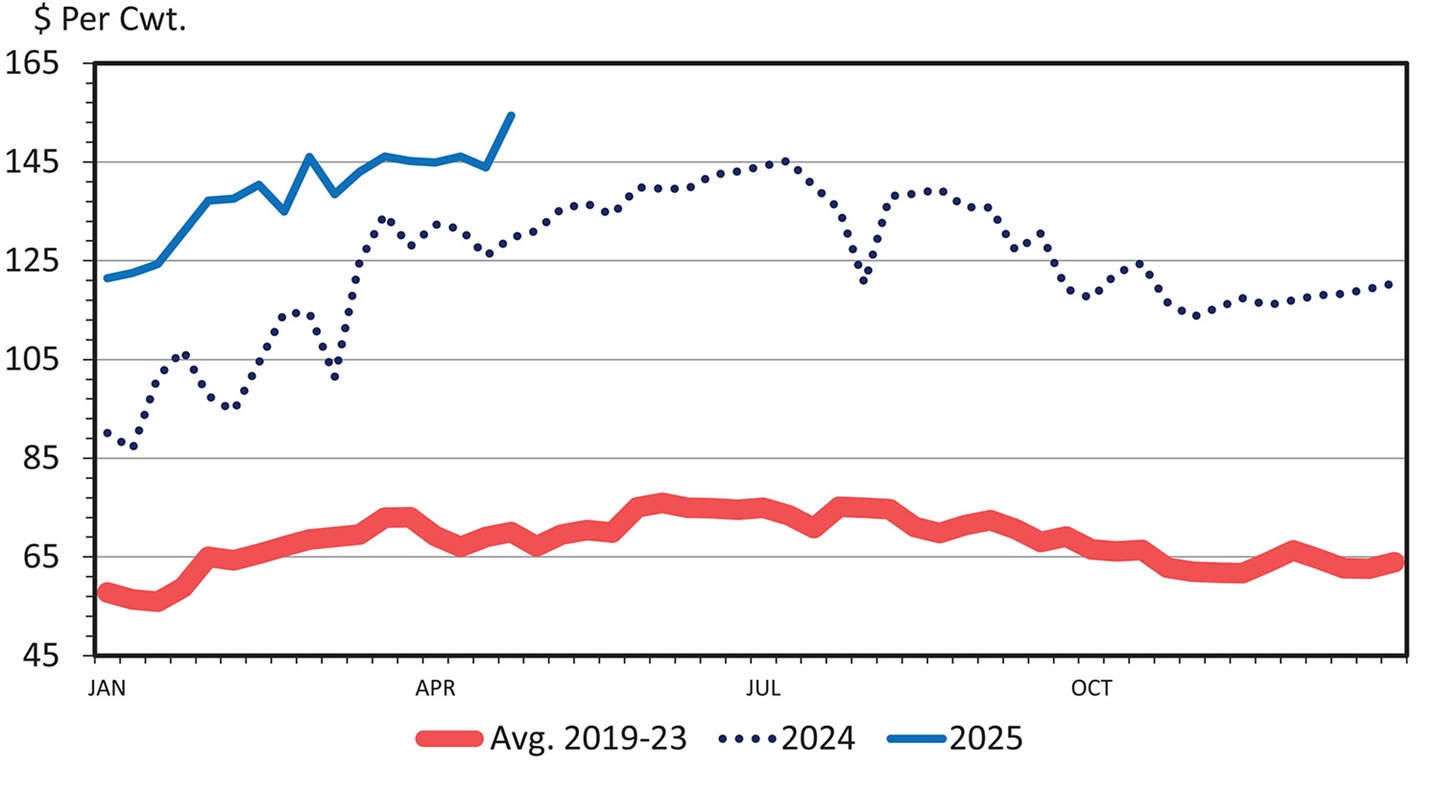

Focusing on the beef side, cull cow values for 85%-90% lean cows averaged $154.39 per hundredweight (cwt.) in the Southern Plains last week, marking an increase of 19.1% from the same week in 2024. This classification generally represents cows with a body condition score (BCS) around 4.5-5.5, depending on dressing percentage. Considering year-to-date figures, cull cow values are averaging $138.67 per cwt., an increase of approximately 23% from the same period last year.

Historically, cull cow prices have shown an inverse relationship with short- and long-run cattle supplies. During liquidation phases of the cattle cycle, beef cow slaughter tends to rise because of lower cull cow prices. Conversely, once cattle supplies tighten, cull cow prices increase, incentivizing producers to retain cows for herd expansion.

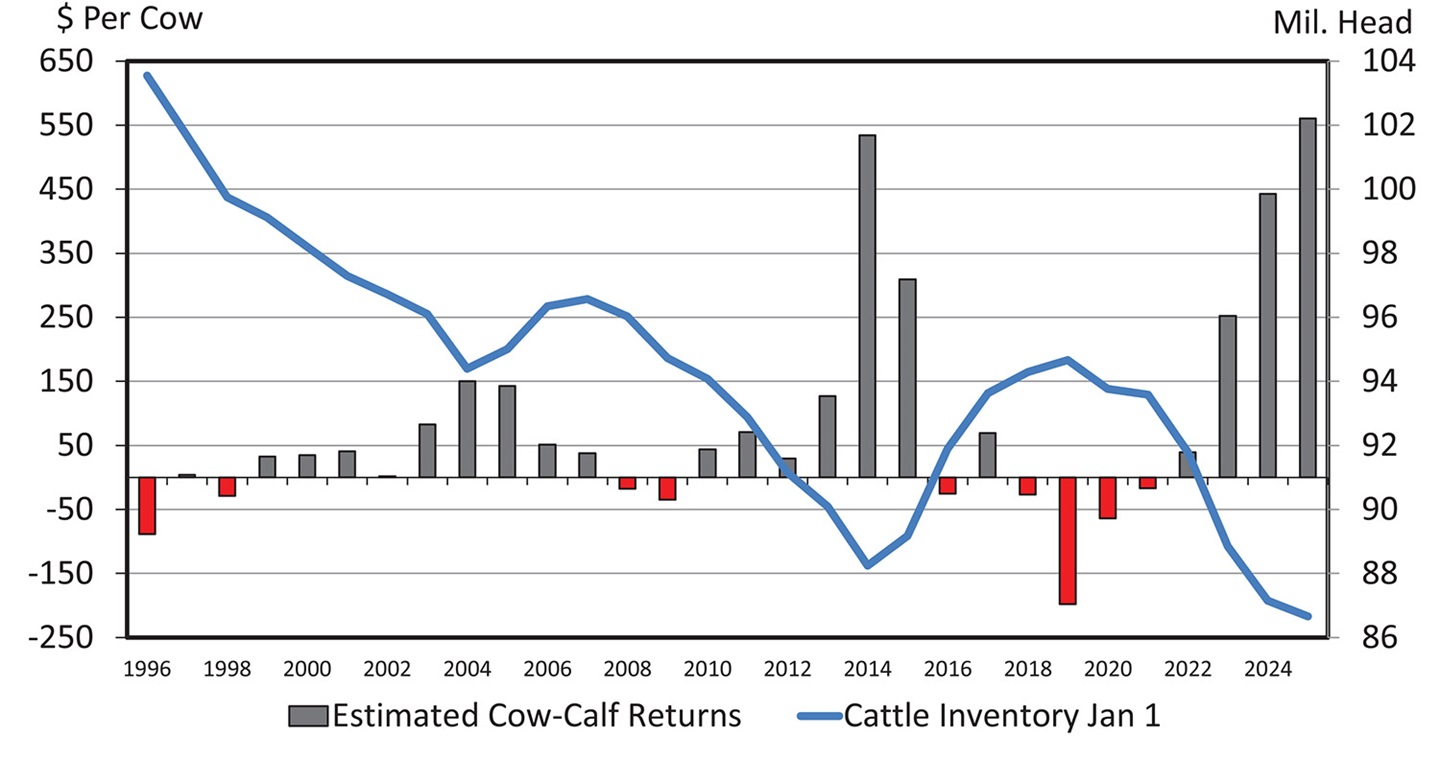

For cow-calf producers, cull cows typically contribute about 15%-30% to annual gross revenue. Currently, estimates from the Livestock Marketing Information Center (LMIC) place cow-calf returns at roughly $561 per cow for 2025, the highest level since 2014, when returns reached approximately $534 per cow.

Fig. 2: Weekly slaughter cow prices, Southern Plains Auction, 85%-90% lean

Data source: USDA-AMS. Livestock Marketing Information Center • C-P-35 • 04/28/25.

Moving forward, drought will also be of significant consideration as feed expenses can contribute substantially to cow-calf producers’ annual expenses. As of April 29, 2025, 31% of national cattle inventories were documented in a drought-affected area, with 28% of hay inventories also being affected. Compared to the same time last year, affected populations have increased by 14% and 16% for cattle and hay, respectively.

Fig. 3: U.S. annual cow-calf returns and cattle inventory

Data source: USDA-AMS and USDA-NASS, compiled and analyzed by LMIC. • C-P-67 • 03/12/25.

Editor’s note: This article is reprinted with permission from the May 2 Daily Livestock Report published by the Steiner Consulting Group, DLR Division Inc.

Angus Beef Bulletin EXTRA, Vol. 17, No. 5-A

Topics: Marketing , News , Industry News

Publication: Angus Beef Bulletin